LAS VEGAS, Oct. 13, 2021 /PRNewswire/ -- Southwest Gas Holdings, Inc. (NYSE: SWX) announced today that it has issued a response letter to Carl C. Icahn addressing points Mr. Icahn raised in his October 4th letter.

Southwest Gas Holdings Board of Directors and Management remain committed to engaging with shareholders and welcome their constructive input on ideas to maximize shareholder value.

The full text of the letter is below.

October 13, 2021

Mr. Carl C. Icahn

16690 Collins Avenue, Suite PH-1

Sunny Isles Beach, FL 33160

Dear Mr. Icahn:

Thank you for taking the time to speak with us last week. We are always open to listening to ideas for enhancing shareholder value and appreciated the open and candid nature of our discussion. Our Board and management are committed to our shareholders and the Company's best interests, including continuously reviewing strategic priorities to drive long term value. That said, I do want to take this opportunity to formally respond to the points that you raised in your October 4th letter – 24 hours before our announcement of the pending acquisition of Questar Pipelines.

Questar Pipelines Is an Especially Compelling Asset That Aligns with Southwest Gas Holdings

Questar Pipelines is a compelling, high-return suite of assets with unique strength and stability. As such, the Questar Pipelines acquisition signifies an increased and significantly diversified regulated business mix, as it provides robust, steady, and contracted cash flows. In fact, contrary to one of your specific points, it meaningfully reduces earnings volatility, and increases strategic optionality and flexibility. Forecasted to be accretive to earnings in 2022—the first full year after the expected close—the transaction will enhance our dividend growth prospects and will help us fund critical, forward-looking investments for continued effective growth. Also, the permanent financing plan strengthens our balance sheet and will ultimately provide us extremely attractive energy transition opportunities in Renewable Natural Gas (RNG) and Responsibly Sourced Gas (RSG), hydrogen and CO2 transportation.

The Acquisition of Questar Pipelines is Appropriately and Fairly Priced

The acquisition is appropriately priced and provides significant value to our shareholders. While the headline price we are paying is 10.9x estimated 2021 EBITDA, after accounting for approximately $200 million in value associated with the tax basis step-up, the adjusted multiple is 9.8x estimated 2021 EBITDA. This valuation is consistent with trading metrics for similar assets, especially recognizing market valuations since the Berkshire acquisition was announced.

Our Financing Plan Rebalances Our Capital Structure and Supports Our Balance Sheet

With committed term loan financing of $1.6 billion, we anticipate that permanent financing will be in place by May 2022. We expect that the takeout financing will include equity and equity-linked instruments and investment-grade bonds (in addition to assumed debt) that will strengthen our balance sheet and further enhance our earnings metrics.

Assertions in Your October 4th Letter Negatively Comparing Our Earned ROE to Other Utilities Are Inaccurate

Your October 4th letter does not take into account the material, strategic and fundamental differences between natural gas and electric utilities, as well as FERC-regulated assets. These differences are critical qualitative data points in the analysis of the strength of this acquisition. This is especially true of their respective capital plans and associated rate base growth profiles, each utility's unique operating conditions associated with the geographic footprint of their service territory, and each utility's ability to potentially increase sales to offset upward pressure on expenses.

Due in large part to the growth occurring in the Southwest, and supportive regulatory relationships, we have a robust capital plan and have been investing in our business, which we believe will continue to translate to greater long-term earnings due to greater rate base growth. Because we must file rate cases to increase our revenue to reflect those investments, there is a regulatory lag that reduces short-term earned ROE. For example, in 2020 we had rate cases in all three jurisdictions that resulted in an increase in rate base of over one billion dollars and rate increases in 2021 that were not reflected in the 2020 ROE.

We Have a Long and Demonstrated History of Constructive Relationships with Our Regulators

Contrary to assertions in the October 4th letter, we have supportive and constructive regulatory relationships with each of our three state commissions – Arizona, California, and Nevada. This belief is supported by our track record on reaching constructive stipulations with stakeholders, receiving approvals on major initiatives, including recent decisions that saw very successful and constructive approvals for our proposals – each of which are a more accurate reflection of the status of our working relationship with regulators and our commitment to working productively with them.

Our Shareholder Returns Continue to Climb

Since the pre-Covid market peak, we have delivered shareholder returns in-line with or better than our peers.

[please refer to the Comparative Stock Price graph]

This and our other investments will drive further improved performance going forward. We also note, as we did on our investor call when we announced the deal, that the Questar Pipelines transaction enhances our ability to continue paying a dividend at a target level of 55% to 65% of consolidated earnings.

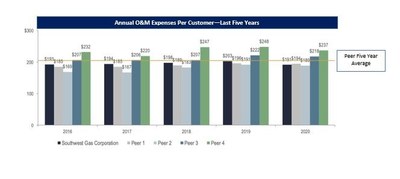

We Remain Disciplined On G&A Costs as Part of Our Overall O&M Costs

Any traditional and fair analysis of our business shows that we have been disciplined on G&A costs and, like all strong companies, we continue to make improvements that increase our efficiency. An appropriate comparison against our Gas LDC peers makes this clear.

[please refer to Annual O&M Expenses Per Customer graph]

Operational efficiency is a priority at Southwest Gas. As we have previously publicly acknowledged, a few de minimis personal expenses (less than 0.01%) were inadvertently included in the rate cases cited in your letter. When we became aware of the issues through the rate case process, we immediately contacted our regulators and withdrew these expenses. We subsequently strengthened controls and instituted additional processes to address and prevent this issue from recurring.

This Transaction Increases Strategic Optionality and Flexibility

Again, like all companies focused on strong and steady shareholder returns, we continuously evaluate our business mix. The Questar Pipelines acquisition significantly increases such optionality for the future of Southwest Gas by broadening our flexibility to source and allocate growth capital. While we do not need to divest or spinoff Centuri to finance the Questar Pipelines acquisition, we will continue to evaluate scenarios that offer the most long-term value for the Company and shareholders.

Board Oversight Is Strong and Average Tenure Has Decreased

We have strong governance and Board oversight. Our ISS Governance Quality Score is 3 on a scale of 1-10, where 1 represents low risk and 10 represents high risk.

We are committed to refreshing our Board over time. With the addition of two independent directors in 2019, both who are utility industry experts, the average tenure of our independent directors is now 10.8 years. Our Board is comprised of diverse and experienced professionals, all of whom bring a variety of relevant skills and experiences to the Boardroom, and our evaluation of additional directors to further enhance our Board is ongoing. At each of the last several Annual Meetings of Stockholders, all Company directors were elected by overwhelming majorities, including the 2021 Annual Meeting, at which all directors were supported by at least 94% of the shares voted.

Our Executive Compensation Is Well-Aligned to Support Long-Term Shareholder Value

On compensation, the independent members of our Board oversee our executive compensation programs and ensure that they are structured appropriately to reward and incentivize performance and shareholder value creation. Our program provides a solid linkage between executive compensation and long-term shareholder value, aligns with best practices recommended by the Compensation Committee's independent consultant, is competitive compared to our peer companies for executive talent and responds to shareholder expectations for pay-for-performance alignment. The Company holds an annual say-on-pay advisory vote regarding executive compensation which is reviewed by the Board and Committee to determine if changes to the executive compensation philosophy, policies and decisions are necessary. At the 2021 Annual Meeting of Stockholders, approximately 98% of the votes cast were in favor of the compensation of the Named Executive Officers. All annual and long-term cash and equity incentives are "at risk" performance-based compensation.

***

We hope this information provides clarity and assurance to you that the Questar Pipelines transaction was considered carefully and thoughtfully. We do believe it will deliver meaningful value for shareholders and help keep us on an important path related to future energy needs. Abandoning it now, as you suggested, would be highly value-destructive and cause the Company to miss a significant opportunity to maintain our commitment to ensuring Southwest Gas continues to grow in strength and stature.

We look forward to engaging with you on these points and any other items you may wish to discuss. Thank you.

|

Michael J. Melarkey

|

John P. Hester

|

|

Chairman of the Board

|

President and Chief Executive Officer

|

Additional Information and Where to Find It; Forward Looking Statements;

Participants in the Solicitation

How to Find Further Information

This communication does not constitute a solicitation of any vote or approval in connection with the 2022 annual meeting of stockholders of Southwest Gas Holdings, Inc. (the "Company") (the "Annual Meeting"). In connection with the Annual Meeting, the Company will file a proxy statement with the U.S. Securities and Exchange Commission ("SEC"), which the Company will furnish, with any other relevant information or documents, to its stockholders in connection with the Annual Meeting. BEFORE MAKING ANY VOTING DECISION, WE URGE STOCKHOLDERS TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS WHEN SUCH INFORMATION IS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE ANNUAL MEETING. The proposals for the Annual Meeting will be made solely through the proxy statement. In addition, a copy of the proxy statement (when it becomes available) may be obtained free of charge from www.swgasholdings.com/proxymaterials. Security holders also will be able to obtain, free of charge, copies of the proxy statement and any other documents filed by Company with the SEC in connection with the Annual Meeting at the SEC's website at http://www.sec.gov, and at the Company's website at www.swgasholdings.com.

Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on current expectations, estimates and projections about, among others, the industry, markets in which Southwest Gas Holdings, Inc. (the "Company," "Southwest Gas Holdings," "SWX," or "we") operates, and the transaction described in this press release. While the Company's management believes the assumptions underlying its forward-looking statements and information are reasonable, such information is necessarily subject to uncertainties and may involve certain risks, many of which are difficult to predict and are beyond the control of the Company's management. A number of important factors affecting the business and financial results of the Company could cause actual results to differ materially from those stated in the forward-looking statements. These factors include, but are not limited to, the timing and amount of rate relief, changes in rate design, customer growth rates, the effects of regulation/deregulation, tax reform and related regulatory decisions, the impacts of construction activity at Centuri, future earnings trends, seasonal patterns, and the impacts of stock market volatility. In addition, the Company can provide no assurance that its discussions about future operating margin, operating income, pension costs, COLI results, and capital expenditures of the natural gas segment will occur. Likewise, the Company can provide no assurance that discussions regarding utility infrastructure services segment revenues, operating income as a percentage of revenues, interest expense, and noncontrolling interest amounts will transpire, nor assurance regarding acquisitions or their impacts, including management's plans related thereto, such as that currently planned in regard to Riggs Distler & Company, Inc. and the pending acquisition of Dominion Energy Questar Pipeline, LLC and related entities (the "Questar Pipeline Group"). Additional risks include the occurrence of any event, change or other circumstances that could give rise to the termination of the Sale and Purchase Agreement by and between Dominion Energy Questar Corporation and the Company (the "Questar Purchase Agreement"), the outcome of any legal proceedings that may be instituted against the Company and others following announcement of the Questar Purchase Agreement, risks that the proposed transaction disrupts current plans and operations, the risks related to the ability of the Company to integrate the Questar Pipeline Group, the amount of the costs, fees, expenses and charges related to the transaction and the actual terms of certain financings that will be obtained for the transaction, potential negative impacts to the Company's credit ratings as a result of the transaction, the disruption to the Company's stock price and the costs, fees, expenses and charges related to, and the distraction of management's attention in connection with, any proxy contest or other stockholder related or similar matters, as well as other risks that are set forth under "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, the Company's Quarterly Reports on Form 10-Q for the quarter ended June 30, 2021 and in future filings with the SEC. All forward-looking statements speak only as of the date of this press release. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are qualified by the cautionary statements in this section. The Company undertakes no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances, or changes in expectations after the date of this press release.

Participants in the Solicitation

The directors and officers of the Company may be deemed to be participants in the solicitation of proxies in connection with the Annual Meeting. Information regarding the Company's directors and officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC and its most recent definitive Proxy Statement on Schedule 14A filed with the SEC. Additional information regarding the interests of such potential participants is or will be included in the proxy statement and other relevant materials to be filed with the SEC, when they become available.

About Southwest Gas Holdings, Inc.

Southwest Gas Holdings, Inc., through its subsidiaries, engages in the business of purchasing, distributing and transporting natural gas, and providing comprehensive utility infrastructure services across North America. Southwest Gas Corporation, a wholly owned subsidiary, safely and reliably delivers natural gas to over two million customers in Arizona, California and Nevada. Centuri Group, Inc., a wholly owned subsidiary, is a comprehensive utility infrastructure services enterprise dedicated to delivering a diverse array of solutions to North America's gas and electric providers.

Contacts

For stockholders information, contact: Ken Kenny (702) 876-7237 ken.kenny@swgas.com

For media information, contact: Sean Corbett (702) 876-7219 sean.corbett@swgas.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-holdings-issues-response-letter-to-carl-c-icahn-301398924.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-holdings-issues-response-letter-to-carl-c-icahn-301398924.html

SOURCE Southwest Gas Holdings, Inc.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-holdings-issues-response-letter-to-carl-c-icahn-301398924.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/southwest-gas-holdings-issues-response-letter-to-carl-c-icahn-301398924.html